What is Captive Insurance?

A captive insurer is an insurance company that is wholly owned and controlled by the organization insured. The primary purpose of a captive is to insure the risks of the organization, while also enabling the owner to benefit from the captive insurer’s underwriting profits.

When you explore a captive with ALT/r, you get an independent review of your options.

Captives are additive and complimentary to your insurance program

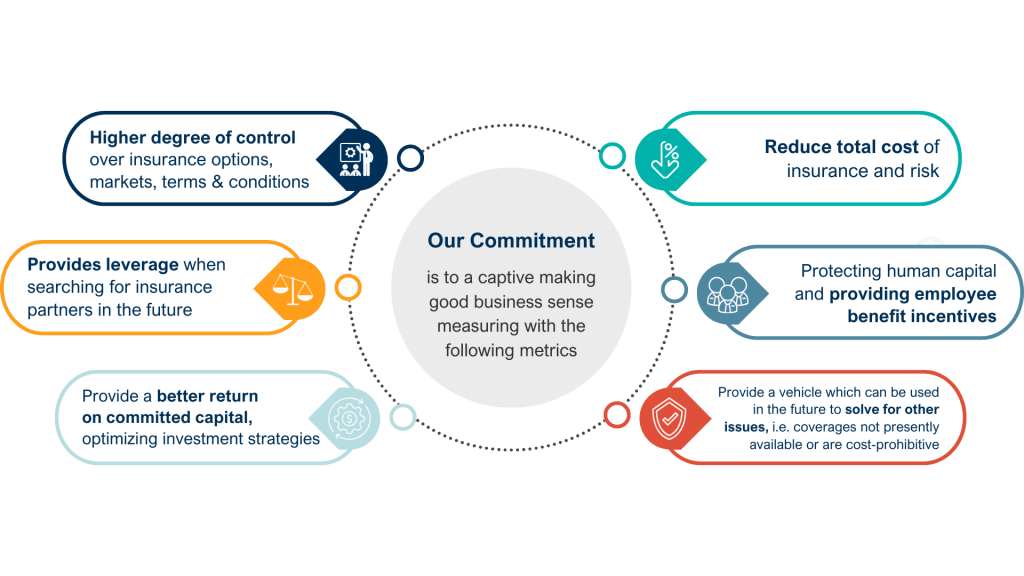

A captive makes good business sense.

Common Types of Captives

Single Parent/Wholly Owned/Equity Captive

Special Purpose Vehicle (SPV)

Risk Retention Group (RRG)

Group/Association Captive

Agency Captive

Sponsored (Rent-a-Captive)

Single Parent Captive Consulting

We prioritize education in every consulting engagement. Our goal is to ensure you understand all aspects of self-insurance and captive insurance before making any decisions. Here’s how we guide you through the process:

What a Captive Can Do For You

- Return of unused premium + investment income

- Potential lower costs

- Lower net effective cost

- Risk control, safety practices and culture

- Create leverage against insurers

- Program and coverage flexibility

- Control over your destiny

- Freedom and flexibility

- Insulation from the pool of other risks

- Customized insurance coverages and program design

Key Value Drivers

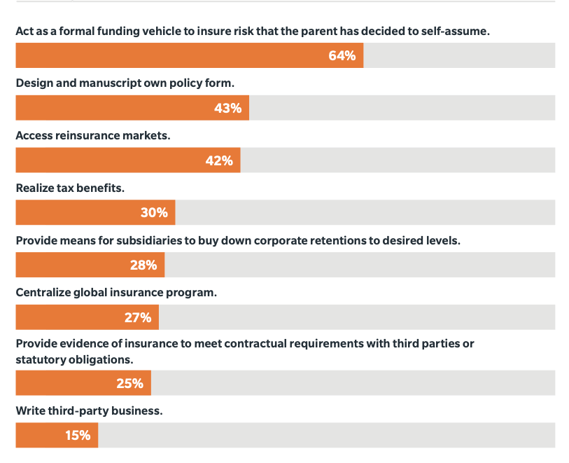

What drives captive growth?

- Reduce insurance cost

- Capture underwriting profit control risk

- Greater control over claims

- Increased coverage

- Incentives for loss control

- Control the cost of risk and pricing stability

- Minimize unpredictable insurance pricing

- Mitigate shock losses

- Provide stability and asset protection

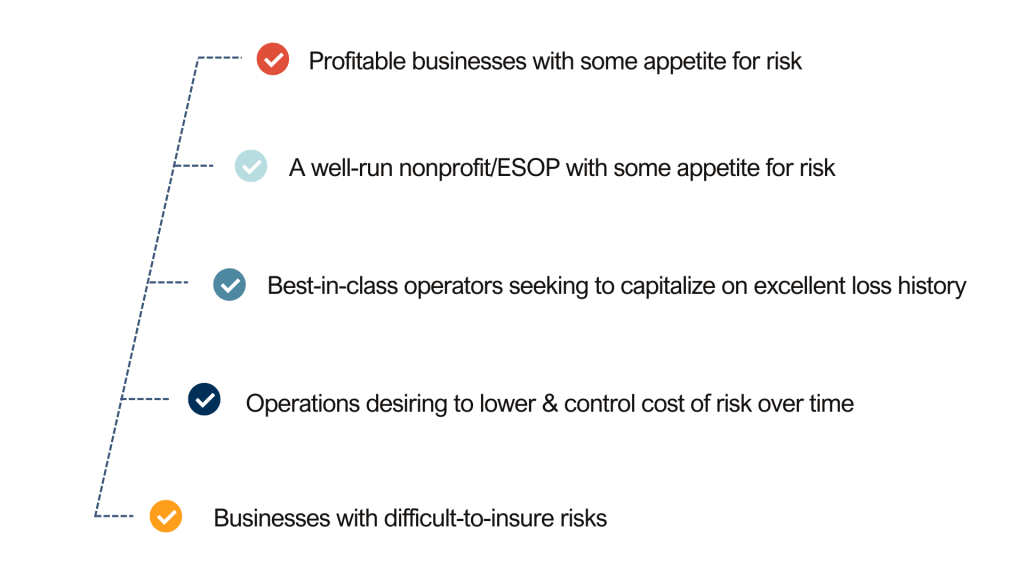

Ideal Candidates for Captives

ALT/r

When you explore a captive with ALT/r, you get the kind of independent review of your options you expect from a top-tier advisor.