When it comes to purchasing health insurance for small to mid-size employers, most feel like they have lost control and their choices are limited as fully insured premiums continue to rise. Also frustrating, is the lack of transparency into what is actually impacting those costs.

This volatile environment is unsustainable for many companies, which is causing them to reconsider becoming self-insured – and for good reason.

Top six reasons mid-size employers consider captives:

Greater transparency

Under a self-insured plan, you will have access to claims information, enabling you to see emerging health and spending trends. You can predict how much you will spend each month on medical claims.

Opportunity for improved cash flow

Claims are paid when they arise instead of paying for insurance in advance. Additionally, employers have an extra layer of protection from catastrophic claim scenarios, rather than the potential cost exposure that comes from traditional self-funding.

Reduced costs and fixed expenses

In addition to the pricing leverage that comes with purchasing as a larger group, captives typically save 3% to 4% in taxes and fees that normally go directly to the fully insured carrier’s operating expenses.

Greater flexibility in plan design

Employers have complete flexibility in creating the plan design that fits the culture and health needs of their staff.

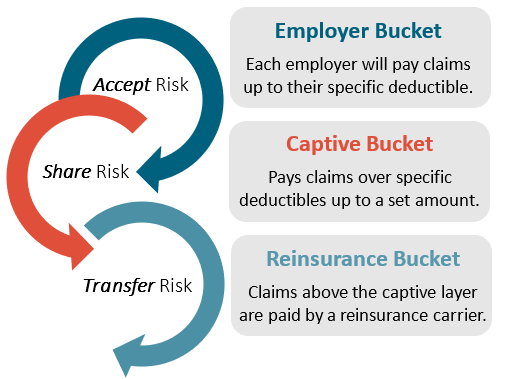

Share risk with other like-minded companies.

By combining self-funding principles and the power of risk pooling, mid-market employers can purchase and manage health insurance plans like a Fortune 500 company.

Premium surplus is retained by the employer.

Unlike fully insured plans, any surplus in variable costs is retained and returned to the employer on an annual basis.

As companies continue to face ongoing challenges such as rising supply costs and unpredictable demand, businesses are on the hunt for any advantage. Evaluating funding strategies for your benefits program is a good place to start.

Captives offer mid-sized companies across most industries an opportunity to design a more customized health plan while controlling medical and pharmaceutical costs. To learn more or to find out if a captive would work for you, let us conduct a comprehensive analysis to determine what solution makes the most sense for your company’s needs.

How it Works